Bitcoin Halving is the event where the number of block rewards are reduced by half. This is done to decrease the dependency on newly minted coins for paying the transaction validators on Bitcoin (miners).

The event also seeks to reduce the market supply for Bitcoin and therefore helping to increase its value.

The Bitcoin halving event, occurring approximately every four years, significantly impacts the network, miners, and the broader market.

Table of Contents

1. Meaning of Halving in Bitcoin

Bitcoin halving is a critical event hardcoded into the Bitcoin network that halves the reward for mining new blocks. By design, this event reduces the rate at which new bitcoins are generated, introducing a deflationary aspect to the digital currency.

This mechanism ensures that Bitcoin mimics the scarcity attributes of precious metals, making it a unique asset in the digital era. The halving event not only underscores Bitcoin’s commitment to a finite supply but also plays a crucial role in its price dynamics and the miners’ economy.

2. Overview of Bitcoin

The Bitcoin It works in a way where individual transactions are verified by validators for known as miners. These miners have to run complex computations to make sure that the hash functions yield the same result for the same transaction regardless of whoever does the validation.

Therefore the minus have to be compensated in a way where it is economical as well sustainable. This is done through the process of reward where for every block that a minor creates and adds to the blockchain there is a certain number of Bitcoins that is awarded as block rewards.

New coins were first used to reward the miners during the initial days but subsequently, it turned into a mixture of transaction fees and block rewards. The idea is to decrease the dependence on newly created Bitcoin and increase the dependence on transaction fees to pay the miners.

3. History of Bitcoin Halving

Bitcoin halvings are to take place till the block reward reduces to 1 Satoshi (1 Bitcoin = 100 Million Satoshis). The last halving event is expected around the year 2100 CE.

First Halving Event – 2012

On November 28, 2012, Bitcoin experienced its inaugural halving event, where the closing price stood at $12.20. Initially, the blockchain technology behind Bitcoin was not widely understood, resulting in a limited number of miners. To incentivize the mining process, the block reward was set at a high number of 50 Bitcoins, equivalent to $610 at that time.

Second Halving Event – 2016

The second halving took place on July 9, 2016, with the closing price of Bitcoin at $650.96. By this time, Bitcoin had garnered increased attention, leading to a rise in transactions and, subsequently, its value. Prior to the halving, the value of Bitcoin had escalated to $963. The event resulted in the reduction of the block reward from 25 Bitcoins to 12.5 Bitcoins, equating to $8,137 based on the value at the time of halving.

Third Halving Event – 2020

On May 11, 2020, the third halving occurred, marking the closing price of Bitcoin at $8,618.48. This event further reduced the block reward from 12.5 Bitcoins to 6.125 Bitcoins, which, at the halving’s market price, amounted to $53,865.5 per block.

Upcoming Fourth Halving Event – 2024 (Expected)

The anticipated fourth halving is expected to take place around April 2024, which will decrease the block reward from 6.25 Bitcoins to 3.125 Bitcoins. Should Bitcoin’s price remain in the vicinity of $41.5k, the reward for each mined block is projected to surpass the previous halving’s value, reaching approximately $130,000 post-halving.

Anticipated Fifth Bitcoin Halving Event – November 2027 to April 2028

The fifth Bitcoin halving event is projected to occur within the timeframe from November 1, 2027, to April 18, 2028. This event will mark another pivotal moment in the cryptocurrency’s timeline, further halving the block reward for miners.

Block rewards will reduce to 3.125 Bitcoins to 1.5625 Bitcoins.

#NOTE: These date estimates are based on my 6 years of experience (2018-2024) in the world of blockchain, crypto, defi and Web3.

Reduction in Block Rewards

Currently, miners receive 3.125 Bitcoins for each block they successfully mine. The fifth halving will reduce this reward by half, resulting in a new block reward of 1.5625 Bitcoins. This reduction underscores Bitcoin’s deflationary nature, designed to decrease the rate of new Bitcoins entering circulation gradually.

Implications

The halving mechanism, as demonstrated in previous events, potentially leads to an increase in Bitcoin’s market value over time. As the reward halves, the scarcity of Bitcoin increases, potentially driving up its price, assuming demand remains constant or increases.

This event is keenly anticipated by the cryptocurrency community for its impact on mining profitability, market dynamics, and the broader narrative surrounding Bitcoin’s value proposition.

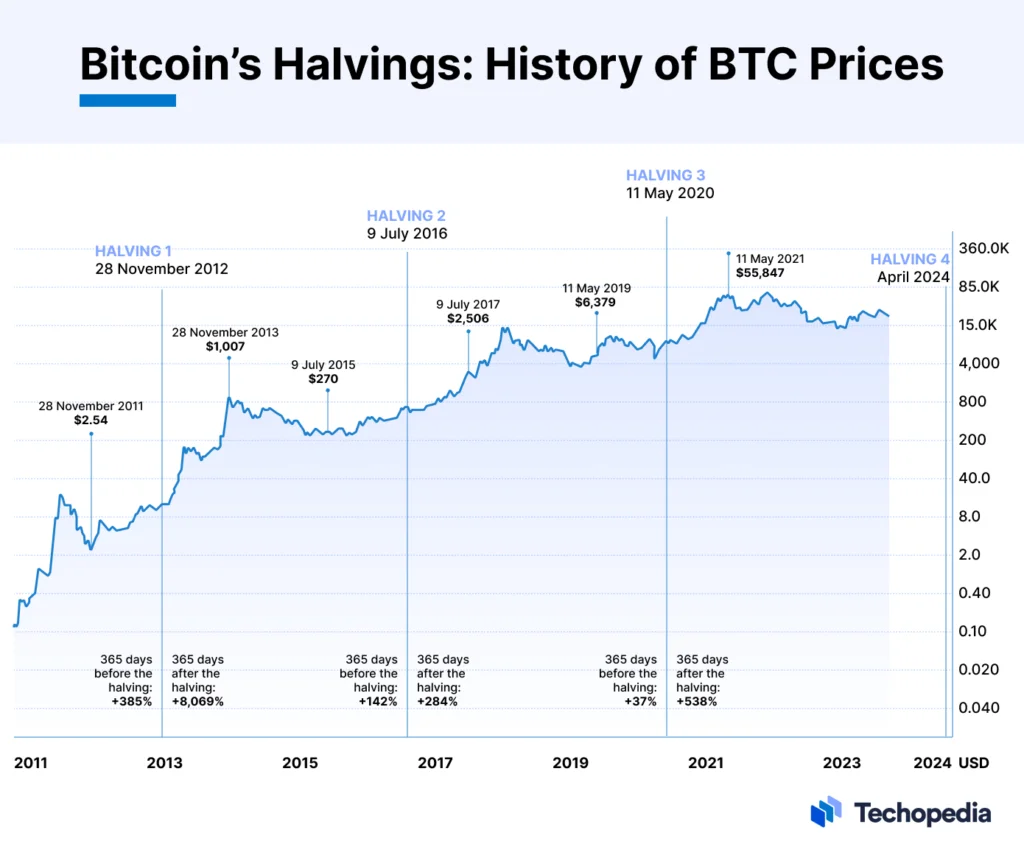

4. Bitcoin’s Price Trend During Halvings

A notable trend observed is that following each halving event, there has been a significant increase in Bitcoin’s price, highlighting the potential long-term value appreciation triggered by these halvings.

First Halving

The phenomenon of Bitcoin halving has historically been a precursor to significant price appreciation within the year following each event. The first Bitcoin halving, which occurred on November 28, 2012, set the stage for an unprecedented growth spurt in Bitcoin’s value. By November 28, 2013, a year after the halving, Bitcoin’s price had surged by an astonishing 8069%. This remarkable growth underscored the halving’s impact on supply and demand dynamics, as the reduced rate of new Bitcoin entering circulation heightened scarcity and spurred investor interest.

Second Halving

Similarly, the second Bitcoin halving on July 9, 2016, followed this trend, albeit with a less dramatic but still substantial increase. Between July 9, 2016, and July 9, 2017, Bitcoin experienced a 284% rise in value. This growth, although not as steep as the post-first-halving year, demonstrated the continuing influence of halving events on Bitcoin’s market value. The sustained interest and increasing adoption of Bitcoin contributed to its rising price, highlighting the cryptocurrency’s growing appeal to a broader audience.

Third Halving

The third halving event on May 11, 2020, further cemented the pattern of significant price increases following halvings. From May 11, 2020, to May 11, 2021, Bitcoin’s price climbed by 538%, showcasing yet another period of robust growth. This consistent pattern of price appreciation following halving events illustrates the cyclical nature of Bitcoin’s market dynamics. It emphasizes the critical role of halving in influencing Bitcoin’s scarcity, market sentiment, and investor behavior, contributing to its cyclical bull runs in the years following each halving.

4. Mining Dynamics Post-Halving

With each halving, the reward for mining new blocks is halved, directly affecting miners’ profitability. This reduction in rewards necessitates advancements in mining technology and efficiency, as miners seek to maintain economic viability.

The event mainly encourages a shift towards more sustainable sources for miner rewards.

5. Implications of Halving

Direct Impact

The halving mechanism, as demonstrated in previous events, potentially leads to an increase in Bitcoin’s market value over time. As the reward halves, the scarcity of Bitcoin increases, potentially driving up its price, assuming demand remains constant or increases. This event is keenly anticipated by the cryptocurrency community for its impact on mining profitability, market dynamics, and the broader narrative surrounding Bitcoin’s value proposition.

Economic Impact

The economic ramifications of Bitcoin halving extend beyond the mining community to influence the entire cryptocurrency market.

By reducing the supply of new bitcoins, halving events exert upward pressure on the price, assuming demand remains constant or increases. This deflationary mechanism is central to Bitcoin’s investment appeal, attracting both individual and institutional investors.

The anticipation and speculation surrounding halving events also lead to increased market volatility. Moreover, since this event makes Bitcoin more scarce similar to gold, they prompt discussions on Bitcoin’s role as a store of value, a medium of exchange, and its comparison to traditional assets like gold.

6. Predictions and Speculations on Bitcoin Halving

Expert Opinions and Forecasts

Leading up to a halving, expert opinions and forecasts proliferate, offering varied perspectives on the event’s potential impact. While some predict significant price rallies akin to past halvings, others caution against over-optimistic expectations, advising investors to consider broader market conditions and macroeconomic factors.

- During a speech at the 2023 Australia Crypto Convention on Nov. 10, Michael Saylor, the majority shareholder of MicroStrategy expects Bitcoin demand to soar 10x within 12 months post the halving.

- Cathie Wood, CEO of ArkInvest, thinks that Bitcoins upcoming halving will entirely redefine the world of crypto markets. ArkInvest and 21Shares have launched Bitcoin ETF.

Analytical Models and Price Prediction Methods

Various analytical models and price prediction methods are employed to speculate on Bitcoin’s post-halving performance. These range from stock-to-flow models, which relate Bitcoin’s scarcity to its value, to technical analysis patterns. However, the inherent unpredictability of markets, coupled with external variables, means these models should be considered with caution.

7. Investment Strategies for Bitcoin Halving

Short-term investors and traders often aim to capitalize on the increased volatility preceding and following a halving event, hoping to secure quick gains from price fluctuations.

In contrast, long-term investors typically view halvings as a reaffirmation of Bitcoin’s scarcity and potential for price appreciation over years, reinforcing the hold-and-accumulate strategy amidst temporary market swings.

Countering Risk and Volatility

Bitcoin halving events introduce a period of heightened uncertainty and volatility in the market. Investors must consider the increased risk associated with price fluctuations that can occur as market participants speculate on the halving’s impact.

Understanding one’s risk tolerance and employing risk management strategies, such as setting stop-loss orders, is crucial during these times.

How to reduce the negative effect of Bitcoin Halving on your investments?

Diversification within crypto assets and beyond can mitigate the risks tied to Bitcoin’s halving events. By spreading investments across various cryptocurrencies, sectors, and asset classes, investors can reduce the impact of Bitcoin’s volatility on their overall portfolio. Effective portfolio management also involves reassessing one’s investment thesis regularly, especially in response to major events like halvings.

8. Cryptocurrency Market Reactions to Bitcoin Halving

Impact on Altcoins and the Broader Market

Bitcoin halvings tend to have a ripple effect on altcoins and the broader cryptocurrency market. While Bitcoin may experience immediate price changes, altcoins can also see varied reactions—some may follow Bitcoin’s price movements, while others diverge based on their fundamentals and market sentiment. The overall market dynamics post-halving often reflect a blend of speculation, investor behavior, and shifts in market dominance between Bitcoin and altcoins.

Speculation and Market Sentiment Analysis

The speculative nature of cryptocurrency markets becomes particularly evident around halving events. Investors and analysts scrutinize past halvings for clues, leading to a surge in market sentiment analysis and speculative trading. The anticipation of potential price increases can fuel bullish sentiment, though it’s crucial to differentiate between speculative hype and genuine market fundamentals.

9. Bitcoin Halving 2024 Price Prediction

Since the halving event is in the next 3 months, I have chosen to use the weekly charts to better capture the trends during the halving phase.

Technical Analysis

- RSI is in an uptrend and is expected to cross levels of 80 during halving which is extremely bullish,

- There are chances that Bitcoin price may cross $67,000 if it crosses $45k before mid-Feb 2024.

Fundamental Analysis

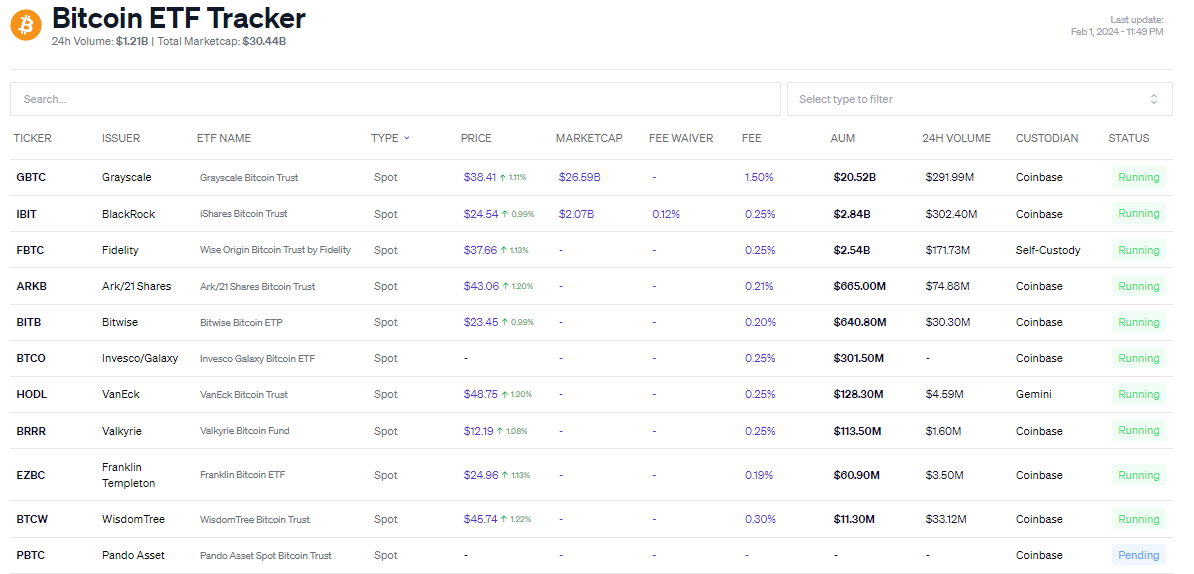

Despite huge outflows in the Grayscale Bitcoin trust it shows that the trust is still the largest one with the 26.5 billion market cap.

Also as of January 2024 there has been a net inflow which shows that more people are adopting Bitcoin ETFs which ultimately ends up buying Bitcoin and therefore increasing its demand in the market.

.Hence we can expect that the demand for Bitcoins is going to be high for the period before and after the halving

10. Benefits and Drawbacks of Bitcoin Halving

Although the Bitcoin Halving will be highly beneficial for everyone due to price appreciation but it also will be destructive for those who are vulnerable to it such as small cryptocurrency owners and small scale miners.

Benefits of Bitcoin Halving

- Increased Scarcity: Reduces the rate at which new bitcoins are created, enhancing scarcity and potentially increasing value over time.

- Price Appreciation: Historically, halving events have led to significant price increases, benefiting long-term investors.

- Incentivizes Mining Efficiency: Encourages innovation in mining technology and practices to maintain profitability under reduced rewards.

- Promotes Long-term Sustainability: By limiting the supply, Bitcoin halving supports the network’s long-term economic sustainability.

- Boosts Investor Interest: Halving events often attract increased attention from new and existing investors, contributing to higher trading volumes and liquidity.

Drawbacks of Bitcoin Halving

- Increased Volatility: Anticipation of halving events can lead to speculative trading, resulting in heightened volatility in the short term.

- Pressure on Miners: Reduced block rewards decrease revenue for miners, potentially pushing less efficient miners out of the market.

- Uncertainty for Small Investors: The increased volatility and market speculation surrounding halving events can pose risks for small or inexperienced investors.

- Centralization Risks: As mining becomes less profitable for small players, there’s a risk of mining power becoming concentrated among large entities, potentially threatening network security.

- Short-term Price Drops: While long-term trends suggest price appreciation, the immediate aftermath of a halving can sometimes see price corrections, catching short-term traders off-guard.