Cathie Wood of Ark Invest highlights a particularly unique aspect of this upcoming Bitcoin halving, suggesting it could redefine Bitcoin’s role in the cryptocurrency market.

The Bitcoin network is poised for its next halving event, a significant moment that cuts the reward for mining Bitcoin in half. This isn’t just another routine update; it’s a pivotal event that distinguishes it from previous halvings.

Table of Contents

Cathie Wood Thinks Bitcoin will Surpass Gold

Cathie Wood points out that post-halving, the growth rate of Bitcoin’s supply will decrease to under 1% annually, a milestone that places it even below the average yearly increase in gold’s supply. This detail is crucial because it directly challenges gold’s supremacy as the go-to asset for storing value.

By reducing the rate at which new Bitcoins are created, the halving event aims to enhance Bitcoin’s appeal as a more stable and reliable store of wealth over time.

Why does this matter?

The essence of value in a free market lies in the delicate balance between supply and demand. Gold has traditionally been valued for its scarcity and slow rate of new mining. Bitcoin is about to step into this realm, offering a comparable, if not superior, proposition. It’s a testament to Bitcoin’s designed purpose: to function as digital gold, a secure and decentralized form of money.

As we edge closer to the halving, the implications for Bitcoin and its positioning against traditional assets like gold are becoming clearer. With nearly 19.6 million Bitcoins already mined, the scarcity factor is set to intensify. This scarcity, coupled with a reduction in new supply, is likely to have profound effects on Bitcoin’s valuation.

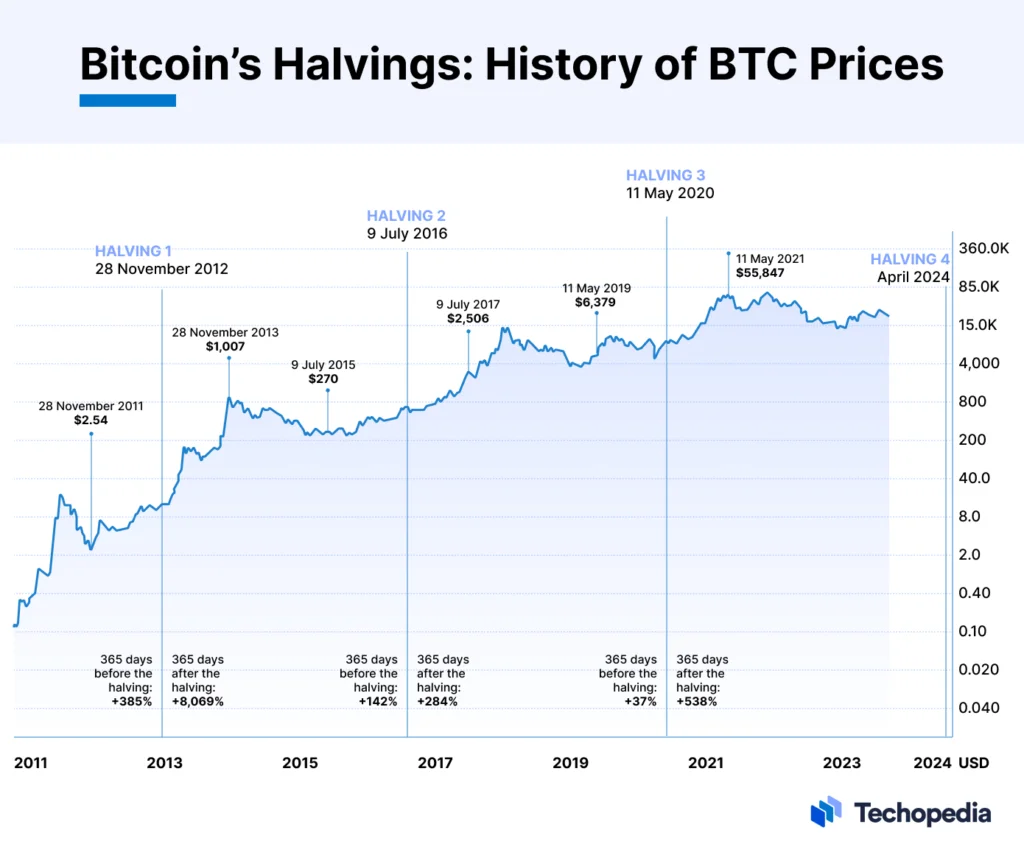

What History Tells about Bitcoin Halvings?

Historically, halving events have led to price surges in Bitcoin’s market value, underscoring the event’s significance. Predictable yet impactful, the halving process is integral to Bitcoin’s economic model, ensuring miners are rewarded while maintaining the network’s security through transaction processing fees.

The upcoming halving is not just another milestone; it’s a testament to Bitcoin’s growing maturity and its potential to redefine wealth storage. While the crypto market continues to navigate challenges, the intrinsic properties of Bitcoin, highlighted by the halving event, suggest a robust future for this pioneering digital currency.

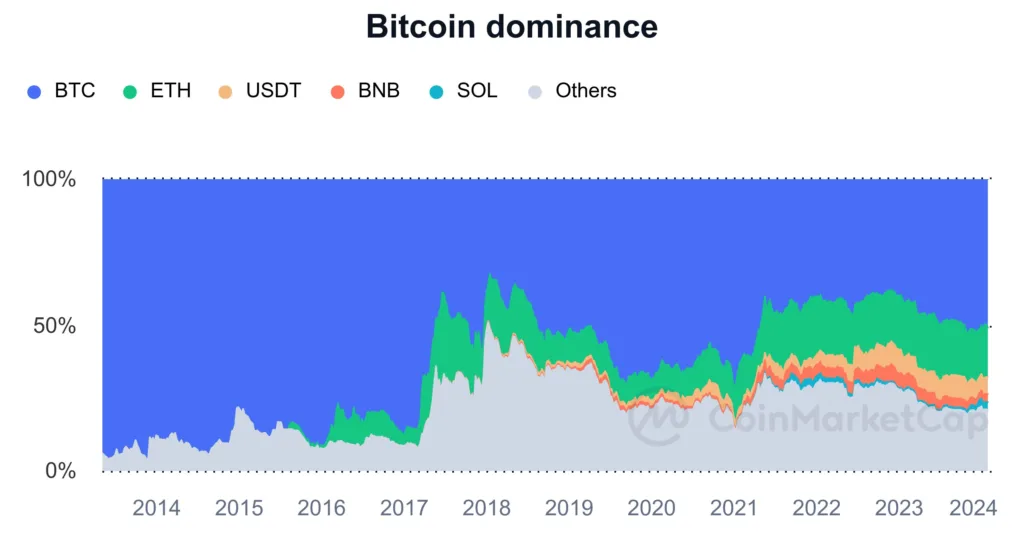

Bitcoin continues to dominate the markets in 2024.

Final Words

The next Bitcoin halving isn’t just a procedural update. It’s a pivotal event that could significantly bolster Bitcoin’s claim as a solid investment and a reliable store of value, potentially even outpacing gold. This makes a compelling case for considering a modest allocation towards Bitcoin in an investment portfolio, mindful of the crypto market’s inherent volatility and uncertainties.