Crypto markets have witnessed a massive fall in open interest for perpetual contracts in the overall markets. The data is from Coin Market Cap. The fall in Open Interest came a couple of days after the Bitcoin ETF was finally approved.

The markets had earlier recorded a $248.9 Billion dollars worth of Perpetual Contracts (by nominal value) as on 11 January 2024 which fell to about $75 Billion on 22nd January. The recorded fall was a 70% decline since the high levels.

Further investigation by Crypto Bulls reveals that these Open interest wear from options market and not from the futures market. The below chart from TheBlock.co shows that the open interest for the futures market remains steady for the entire period of January 2024.

We found that the majority of volume of the perpetual contract open interest came from the options market.

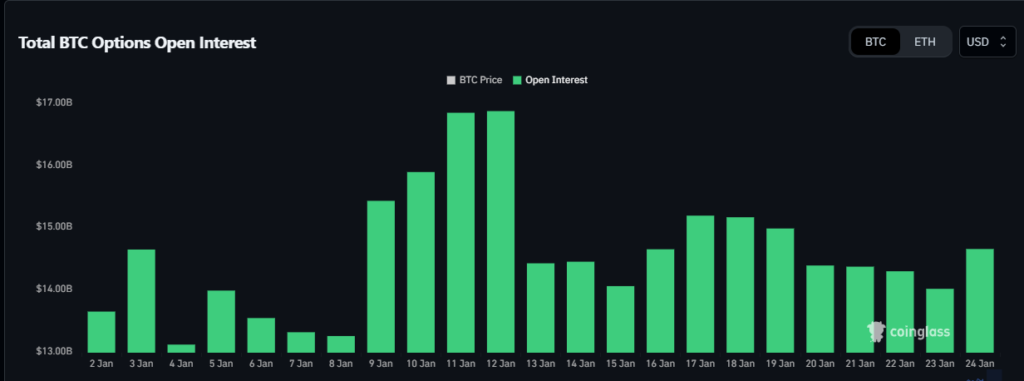

Below is a screenshot from Derebit which is one of the largest crypto options market and here we can see that after 11th and 12th January there has been a abrupt decline in the total Bitcoin options open interest

Table of Contents

Reason for Fall in Open Interest

From the initial investigation it seems that the open interest was liquidated as a result of the Bitcoin ETF approval we can see that from 11th of January 2024 to 22nd of January 2024 there were enough liquidations Both long and short that could have brought down the perpetual contract open interest.

What are Perpetual Contracts?

A perpetual contract is a future trading contract that has no expiry date it allows the user to buy the future of their desired crypto and exit at their desired date. They usually have a very high leverage which helps traders reap more profits than what would have been possible through spot buying.

However, in case when the profits are very high or the losses are too large they might get forcibly liquidated by the respective exchanges.

What is Open Interest?

Open interest is a net sum of nominal value (in Dollars, Rupees, Yen or Pounds) of all the futures (or options) contracts that are created on a given asset. If liquidated, this is the amount that could be exchanged if the buyer and the seller decide to execute their rights.