Bitcoin has bounced back from its support of $41.3k and might head towards $43k as next target. The bounce back came as a result of RSI touching its reversal levels (40 during bull markets).

Bitcoin had witnessed selling in the last 11 days since Jan 10, because of profit booking after the Bitcoin ETFs.

Technical Analysis

Market Overview

Bitcoin was trading near $41,700 at press time, up by 0.05% since yesterday. The market cap was at $817 Billion.

I have used daily charts to estimate the movement of the cryptocurrency as it captures short term movements with a fair degree of accuracy.

After reaching a yearly high on $48,969 (intraday basis), Bitcoin witnessed profit booking. This continued for a bit till 12 Jan 2024.

Then, Bitcoin broke down its support of $43k on 12 Jan 2024. It again tried to cross the level from downside but failed. The price then took support near the levels of $41.3k.

What do Indicators Say?

Technical indicators RSI and MACD are pointing towards different directions.

- The RSI shows that Bitcoin has gained some strength and has reversed from the RSI levels of 42, which is the bottom level for a bull market.

- MACD still paints a negative picture for Bitcoin but I am convinced that it will too turn favorable soon.

- Volumes are on the mixed side since last 10 days but since yesterday, the volumes have turned towards the buying side.

Option Chain Analysis

The options market is expecting an up move in Bitcoin’s prices. The highest amount of call options are on $50,000 strike which shows that the markets have factored in that a move till $50,000 is difficult in the near term.

The overall Put/Call ratio is now valued at nominal 0.29 which shows that more people are still shorting the markets than getting long. This also means that a high number of people are still betting on the downfall of the market.]

Sentiment Analysis

As on 21 Jan 2024, the Bitcoin Fear and Greed Index is at 56 which means that people are still skeptic of the market’s further growth.

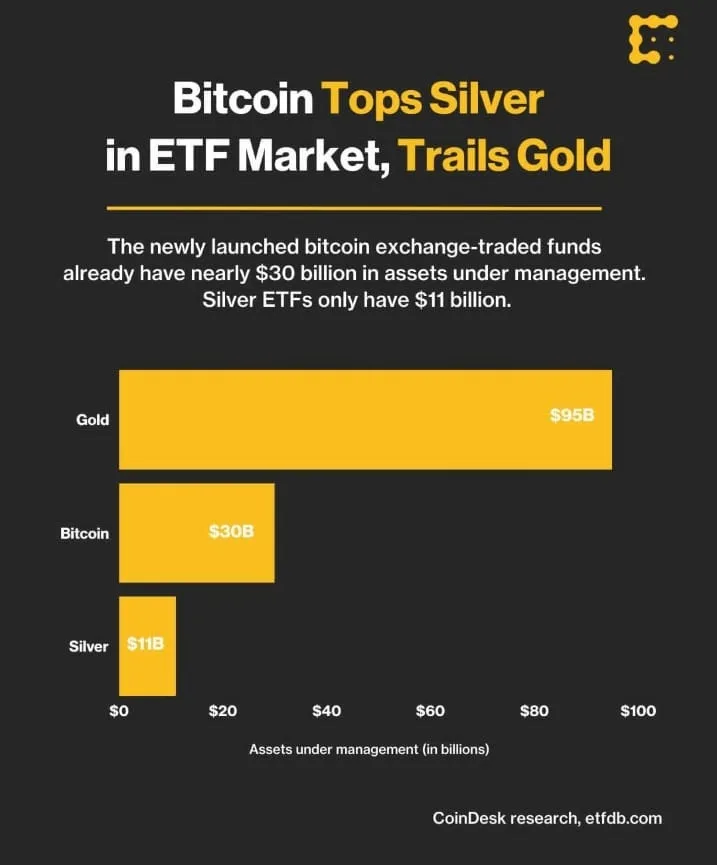

I believe these fears are mis-placed because the recently approved Bitcoin ETF have recorded a market volume of $30 billion within 10 days surpassing the combined Silver ETF market (11 billion).

Where is Bitcoin Headed?

Combining the technical analysis with on-chain and sentiments, I gauge that Bitcoin is headed first towards $43k, then $47k and finally $50k. However, the price of $50k is not expected until March 2024 as indicated by Option Chain data.

Disclaimer: This is not trading advice, neither is financial advice. Until there is a regulatory approval for Crypto Advisors, we will stick to presenting just research.